Hogwash Edition #13 - Checking In

focus on your process

folks, ladies, gentlemen.

been just over a year since the last post. hope all is well.

system status:

crypto - financially brutal - stepped back for a few months. incurred some massive losses. got a little overzealous and made some horrific trades with size. this is the result of overtrading.

career - place of employment (large corporate manufacturing - if anyone does IIOT stuff msg me) shutdown. searching for next gig, have some free time again.

cranium - mentally and physically regrouped, and continuing to do so. return to the area is imminent.

re-established strategy, specifically separating funds into three buckets:

trading

mid term investments

long term investments

focus primarily on the systems and processes you have personally established, don’t deviate.

don’t chase.

“the man who chases two rabbits catches neither”

anyways…..

the crypto market has been in a strange place. getting hammered.

trump rally hasn’t been all its cracked up to be.

not as explosive as we all had hoped, but we shall get there.

but i think the right environment to harbor crypto in the US, legitimately embraced from a policy and regulatory standpoint, is being formed.

moving away from policy orchestrated with malicious intent (gary), or bureaucratic processes (intentional death drag out) clogging up any real progress.

trump’s general approach has been towards deregulation, economically and organizationally. it should be fair to assume we’ll be in for proper regulation establishment with minimal regulatory oversight.

thus leading to further adoption, over time.

letting the industry flourish, and publicly recognized as, investable, businesses by the general public.

plus,

david sacks is a smart guy, made a lot of money. even if he has his own interests in the space, i think he’ll continue to do the right thing as the “crypto czar” (love the title).

heck, hard to even argue he has many *finically* motivated interests left, considering he sold all of his crypto holdings.

seeing he has like 0.1% remaining crypto investment - in the form of some LLC that is being disolved. so for all intents and purposes - he’s out.

i think he just wants to see crypto win, and win in the US.

world liberty buying still… (around march 5th, couple weeks ago)

plus,

SBR - Stratic Bitcoin Reserve establsihed on march 6th. Effect of this will be minimal in terms of price, but offers more legitamcy to btc, and crypto wholistically.

now, with all of that being said, you may care or dismiss it.

SBR is insignificant, yada, yada, whatever.

BUT,

the way i see it is, there’s too many big players in the game for the large market assests (btc eth sol at the very least) to lose value ***over a long enough time horizon***.

blackrock simply does not lose money. they wont lose money to retail.

feels like a shakeout period to me.

all boats rise will rise too when that time comes.

other positive recent news from FDIC:

Matthew Sigel, head of digital assets research at VanEck, celebrated the FDIC’s decision as a “big win against Chokepoint 2.0.” He added that removing reputational risk means “fewer excuses to debank industries they don’t like.”

end of debanking in crypto?

a note on quantum computing:

“having done some work in both, there’s a general feeling that our ability to make crypto safe from quantum is much greater than our ability to make scalable quantum computers.”

^^^i think this is the general consensus for most people, we will find a way to protect against it.

just like all other non-crypto existing systems that are susceptible.

algorithims can advance along side quantum.

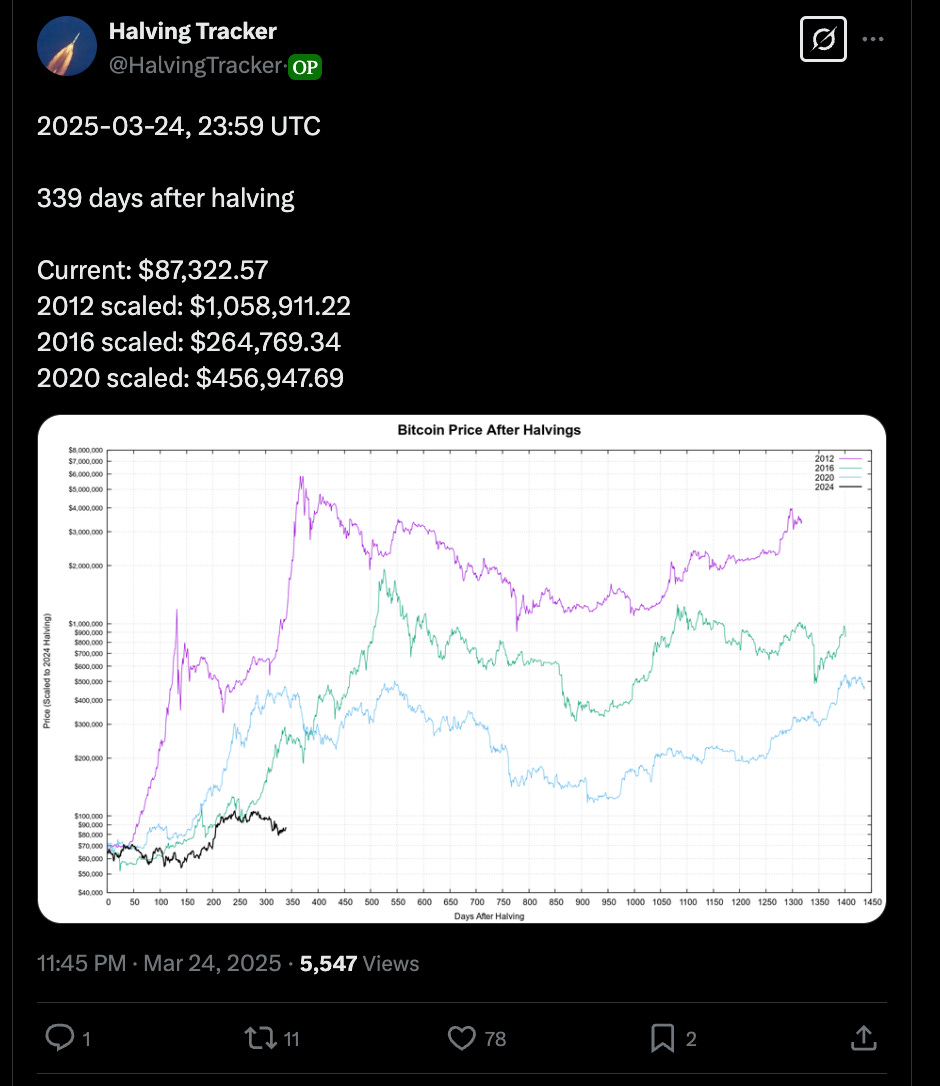

halving status:

prices today:

well, that’s it for now.

happy to be back.

will be writing more about other topics, not solely crypto, which had been the primary focus before.